A large part blockchain’s promise is around creating open financial systems. By this I mean:

- Removing intermediaries

- Enabling peer to peer transaction

- Reducing coordination costs

- Creating high trust transactions

- Reducing fees and wait times

At ETH Denver, one of the largest Ethereum hackathons, attendees were provided with a burner wallet which enabled them to buy lunch from about a dozen different food trucks. Attendees were able to get their mobile based wallet up and running in about 15 seconds — and over the weekend over 4,405 transactions (totaling $38,432.56) occurred flawlessly.

The burner wallet was powered by BuffDai – a stable coin that equals 1 US – and was created by Austin Griffith. Sound complicated? Really all this means was that users had a browser based wallet where they scanned a QR code and paid out their money to the vendor.

But what shocked me most about this payment network was how low the fees were.

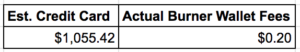

For 4,405 transactions (totaling $38,432.56) the entire fees paid to the Ethereum Network were ~$0.20.

Think about that implication for a moment. Traditional merchant processors charge about $0.10 plus 1.6% per transaction. Let’s break this down for a minute. If attendees had the same number of transactions using their credit cards than the fees paid to facilitate those transactions would have come out to $1,055.42 (assuming 10 cents per transaction plus a 1.6% fee).

The implications from this aspect of ETH Denver are pretty vast.

Imagine what will happen to the large credit card networks (Visa, Mastercard, and American Express) if they see a 99% reduction in their fee structure.

The open finance revolution is coming – and most traditional finance firms aren’t prepared for peer to peer transactions.